image copyrightGetty ImagesUS retailer Gap could close all of its own UK stores, putting thousands of jobs at risk, as it mulls shifting its operations to franchise-only in Europe.Shops in the UK, France, Ireland and Italy could shut next summer, along with its UK-based European distribution centre, the retailer said.Gap would not disclose the number of UK stores it has, nor the size of its workforce.Falling sales in recent years have been exacerbated by coronavirus disruption.The retailer reported a £740m loss in the three months to May.Instead of operating its own stores, Gap said it was looking at whether to move to a franchise model. The retailer had 129 Gap-branded stores in Europe at the end of July, and about 400 franchise stores.”As we conduct the review, we will look at transferring elements of the business to interested third parties as part of a proposed partnership model expansion,” said Mark Breitbard, head of Gap brand global.A Gap spokesperson added it was also looking at “alternative ways to operate the European e-commerce business.” The spokesperson declined to give a breakdown of the number of stores and employees Gap has by country.Clothing retailers have been hit hard by the coronavirus crisis. As well as temporary shop closures during lockdown, they have had to contend with lower footfall and an accelerated shift to online shopping which has been capitalised on by specialists such as Asos and Boohoo.Many retailers have struggled to survive amid the crisis, according to the Centre for Retail Research. These include:Edinburgh Woollen Mill, which owns Jaegar and Austin Reed has filed notice to appoint administrators, putting 21,000 jobs at risk.Debenhams, which said in August it would cut thousands of jobs, is up for sale and trying to find a new owner.The DW Sports chain which entered administration in August threatening 1,700 jobs.Scots-based clothing retailer M&Co which has gone into administration and said it would cut nearly 400 jobs in August.Even before the pandemic, Gap was fighting to revitalise itself after losing younger shoppers to cheaper fast fashion brands such as Zara, H&M and Forever 21 over a number of years.Earlier this year, Gap said it planned to close over 225 unprofitable Gap and Banana Republic stores globally as a part of a restructuring plan.

BBC Business News Articles

Covid: Virgin Holidays 'must pay refunds or face court'

Virgin Holidays has been ordered to meet refund deadlines following Covid-related cancellations or face court action by the regulator.The company has agreed to pay refunds by 30 October for any holidays cancelled before September.Those cancelled last month or this month will be refunded by 20 November.By law, package holidays cancelled by an operator should be refunded within 14 days, but some people have waited three months to get their money back.’Unreasonable’Virgin Holidays has received 53,000 refund requests since the start of March, totalling £203m – a situation which it said had put the company under “extraordinary pressure”. The company said it had 1,300 claims left to process, which it said would be done by the end of the day.The Competition and Markets Authority (CMA) said it had received hundreds of complaints that people were not receiving refunds for holidays cancelled owing to the pandemic.It said many customers had been forced to wait for an “unreasonably long time”, with some told the refunds would take three months.If Virgin Holidays fails to hit its deadlines, the regulator said it was prepared to take the company to court. This included refunds for Virgin Holiday Cruises.Your Virgin refund nightmaresHolidaymakers have spoken to the BBC in recent months over the stress of getting refunds from Virgin Holidays.image copyrightDavid and Natalie RogersNewlyweds David and Natalie Rogers, from Dudley, saved for two years for their dream honeymoon safari trip in Kenya but coronavirus ruined their plans.”We were quite angry about having to wait on hold [to Virgin Holidays] for over eight hours, and a message on the line saying that travellers should have already received a voucher for their missed holidays. It just felt like we’d been forgotten about,” they said.image copyrightLynn FoxLynn and Martin Fox had remortgaged their home to pay for a holiday of a lifetime with their two children in Florida.”If only they [Virgin Holidays] would have been honest with us and communicated with us, we would have been happy. If they put a date on the refund, we could have planned. But the phone cut off calls and emails were ignored,” Mrs Fox said.Hannah Nash and her family paid nearly £7,000 for a holiday to Disney World in Florida but struggled to get a refund.”The stress is making me ill. These are not small amounts for normal people,” she told the BBC in June.Andrea Coscelli, chief executive at the CMA, said: “Our action means that Virgin Holidays customers should receive all their money back without further delay.”We are continuing to investigate package holidays in relation to the coronavirus crisis. Should we find that any business is not complying with consumer protection law, we won’t hesitate to take action.”The regulator has issued similar warnings to other companies including Sykes Cottages and Vacation Rentals.A spokesman for Virgin Holidays said: “We have gradually reduced refund timeframes and are now 98% through the refund queue.”Our focus now is on rebuilding trust with our customers, recognising that it has regrettably taken much longer than normal to process their refunds. We thank them sincerely for their patience throughout.” What are my rights?If you have a package holiday cancelled by the provider, then a refund should be provided for the whole holiday within 14 daysIf your flight is cancelled, you are entitled to a full refund to the original form of payment within seven days, although many airlines are struggling to meet that deadline. You can accept, or refuse, vouchers or a rebooking but a voucher will probably be invalid if the airline later goes bustIf you decide against going on a future flight, which is not yet cancelled, then there is no right to a refund. Different airlines have different rules over what you can do, but many are waiving any charges for changing to a later flight or having a voucher instead. Your travel insurance is unlikely to cover youimage copyrightReutersRegulation of holidays and flights is divided between the CMA and the Civil Aviation Authority (CAA).The CAA has now announced that refund credit notes (RCNs) will have greater protection than normal until the end of the year.RCNs were handed out by some companies instead of refunds early in the coronavirus crisis, as the businesses found themselves stretched by the level of claims. Customers must be given a cash refund if they ask for one.RCNs can be used to book another holiday, or a refund is given when the note expires.They have been temporarily protected under the Atol scheme, which is government-guaranteed and administered by the CAA.Protection has been extended to cover any issued between 1 October and 31 December. It will apply to all relevant vouchers issued by Atol holders operating within the UK.This means that the refund will be honoured, and can be drawn from a central pot, even if the provider goes bust.

Covid-19 app users can't get isolation payment

People who are told to go into isolation in an alert from the NHS Covid-19 app in England and Wales will not be eligible for government support. Anyone on low income who is instructed to self-isolate in a phone call from NHS Test and Trace can claim a £500 payment from their local authority.Now the Department of Health has said the payments will not be available to app users, as reported by Sky News.However, the government is exploring ways of changing that.A spokesperson said: “The NHS Covid-19 app is voluntary with users of it remaining anonymous, which means that currently people are not eligible for the support payment if they are advised by the app to self-isolate.”When the app was rolled out a month ago, there was at first some confusion about whether its alerts to users who had been in close contact with an infected person, would be legally enforceable. But eventually the government conceded that, as there was no way of knowing who had received these alerts, obeying their instructions would be voluntary.People who are contacted by NHS Test and Trace and told to self-isolate, face fines of up to £10,000 if they fail to comply.The NHS Covid-19 app is built on a framework designed by Apple and Google, which is designed to give as little data as possible to governments and health authorities. How does Covid-19 test-and-trace work?A previous version of the app which would have seen more data collected centrally, was abandoned after concerns were raised by privacy campaigners.The Department of Health says it is “actively exploring’ ways of expanding the £500 support scheme to include app users. But it is not clear exactly how this could be done without compromising the anonymity which is guaranteed to users when they install the app. There will also be concern that offering payments to app users who are sent isolation alerts may encourage fraud.More than 18 million people have installed the NHS Covid-19 app since it was rolled out in England and Wales on 24 September. Similar apps were made available earlier to people in Scotland and Northern Ireland.

KFC to create 5,400 jobs in the UK and Ireland

image copyrightGetty ImagesKFC says it plans to add 5,400 jobs in the UK and Ireland by the end of 2020, despite many of its outlets being in areas affected by Covid restrictions.The fast food chain has 965 restaurants across the UK and Ireland.The company says some of the new jobs will be funded by the UK government’s Kickstart scheme, which is designed to help young people.The 16-24 year old age group has been disproportionately hit by job losses in the pandemic.The new jobs come at a time when the UK’s hospitality sector is reeling from the effects of the coronavirus pandemic.Local lockdowns and restrictions have forced many restaurants, bars and pubs to close, or work at reduced capacity, prompting Chancellor Rishi Sunak to introduce new measures to prevent mass job losses, when the furlough scheme ends in November.New Covid rescue scheme to pay up to half of wagesUnemployment rate hits highest level in three yearsThe unemployment rate in the UK rose to 4.5% in the June-to-August period, the highest level in three years.But amongst 16-24 year olds who are able to work the figure is 13.5%.”This year is going to be even more challenging for young people looking for job opportunities,” said Paula Mackenzie, general manager at KFC for the UK and Ireland.”But we know that all the skills the hospitality sector teaches – the importance of hard work , delivering great service and working as part of a team – will hugely help them in the long run.”The government’s Kickstart scheme, which KFC says will fund some of the new jobs, pays employers £1,500 for every 16-24 year-old they train. It is aimed at young people who are on Universal Credit and at risk of long-term unemployment.The new posts will be in addition to the 4,300 new recruits the fried chicken chain says it has taken on since the first lockdown in March.

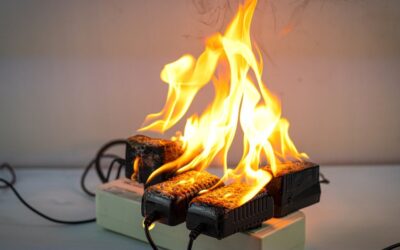

Dangerous products: 'I heard a loud crackle and bang'

image copyrightGetty ImagesDangerous kettles, hairdryers and extension leads are being sold online, an investigation has found, prompting calls for a change in the law.One mother-of-two said she heard a “loud crackle and bang” from a laptop battery bought via an online marketplace before fire broke out.Experts at Electrical Safety First also found hoverboard chargers that were an electrocution risk.The charity wants platforms to have more responsibility for what is sold.Tens of thousands of these products could have been sold via online marketplaces, it said.Illegal itemsThe charity’s snapshot investigation found 70 listings of visually non-compliant electrical products for sale, thousands of which were likely to have been sold.Products were analysed from the images used to advertise them and considered to be so obviously substandard that they were illegal for sale to UK consumers, the charity said.Amazon and eBay ‘listing unsafe toys for sale’Amazon and eBay evict sellers amid VAT crackdownSome of the listings had illegal plug fittings. Some were fitted with EU plugs, and sold with a UK adapter to use permanently, which increases the risk of an electric shock or fire.It found products of concern sold on Amazon Marketplace, Wish and eBay. The companies said the products had been taken off their sites immediately. In some cases action was taken against sellers, and the sites said they had monitoring in place to prevent the sale of dangerous items.’I was terrified’image copyrightElectrical Safety FirstOne mother-of-two from North Wales said she had bought a replacement battery for her laptop from a third-party seller on an online marketplace, but said it led to a fire.”My laptop was on a hard table, charging for a few hours. I heard a very loud crackle and bang from the laptop. Panicking, I fled into the garden, taking my dogs with me and looked in horror to see the laptop go bang again and catch fire, spreading along the table,” she said.”I was terrified. Luckily, my two kids were staying at their grandmother’s that night but if they’d been in the house at the time the fire would have been between them and myself which is absolutely horrible to think about. “The experience has taught me not to buy electrical products from online marketplaces again. I’ll be sticking to reputable retailers.”The charity said more needed to be done to protect consumers, claiming current rules were “ambiguous”. It has drafted a proposed change in the law, including:Online marketplaces bound by a clear legal obligation to prevent the sale of substandard productsEnsuring responsibility does not lie entirely with the third-party seller using the sitesOnline services required to alert consumers who have bought a product found to be substandard, rather than only taking down listingsLesley Rudd, chief executive of Electrical Safety First, said: “Quite rightly, our High Street retailers are bound by legal responsibilities and it is wrong that online marketplaces can operate outside of this framework.”It is time to even the playing field to finally tackle the scourge of substandard goods we continue to find on sites. We urge the government to adopt our Bill in order to protect millions of UK consumers and to hold online marketplaces to account.”

Britain and Japan sign post-Brexit trade deal

image copyrightEPABritain and Japan have formally signed a trade agreement, marking the UK’s first big post-Brexit deal. The deal, unveiled last month, means nearly all its exports to Japan will be tariff free while removing British tariffs on Japanese cars by 2026.UK International Trade Secretary Liz Truss called it a “ground-breaking, British-shaped deal”.But critics have said it will boost UK GDP by only 0.07%, a fraction of the trade that could be lost with the EU.The two countries had reached a broad agreement in September, and the deal is expected to boost trade between the UK and Japan by about £15bn.The deal, which was negotiated over the summer, will take effect from 1 January 2021. But some experts said it was a missed opportunity between the UK and its 11th biggest trading partner.image copyrightChristopher FurlongDr Minako Morita-Jaeger, international trade policy consultant and fellow of the UK Trade Policy Observatory at the University of Sussex, said: “Given that Japanese FDI (Foreign Direct Investment) has been playing an important role in the UK economy and retaining its existing investment in post-Brexit is crucial, the UK government should have shown a strong commitment to Japanese investment by including a comprehensive investment chapter encompassing investment protection and dispute settlement.”She added that Japan was the largest investor abroad in the world, accounting for 14% of the world total in 2018.The new deal is very similar to the existing EU-Japan deal, but has an extra chapter on digital trade.”It used to be said that an independent UK would not be able to strike major trade deals or they would take years to conclude,” said Ms Truss at a joint press announcement with Japan’s Foreign Minister, Toshimitsu Motegi.Mr Motegi said a deal between the UK and the EU was still crucial for Japanese business, particularly carmakers such as Nissan and Toyota who use parts from across Europe in vehicles they assemble in the UK.”It is of paramount importance that the supply chain between the UK and the EU is maintained even after the UK’s withdrawal,” he said.

Shoppers defy economic gloom in September

image copyrightPA MediaBritish retail sales have continued to increase for the fifth consecutive month, boosted by non-food items including DIY and garden supplies, according to official figures.The Office for National Statistics (ONS) said retail sales volumes rose by 1.5% between August and September.Spending on groceries remained high, but petrol sales were still down as motorists made fewer journeys.Sales are now 5.5% higher than the pre-pandemic levels seen in February.The three months to September saw the biggest quarterly increase on record, as retail sales volumes increased by 17.4% when compared with the previous three months. However, analysts warned that the sales surge was unlikely to last, with many parts of the country returning to coronavirus lockdown.New government Covid scheme to pay up to half of wagesUK prices rise faster after Eat Out scheme ends”While food sales have done well in recent months as people have eaten out less, non-food store sales have now made a recovery at 1.7% above their February levels,” the ONS said.”Home improvement sales continued to do well in September, with increased sales in household goods and garden items within ‘other’ non-food stores.”Fuel lowerFuel was the only main sector to remain below February’s pre-pandemic level, the ONS said, with volume sales 8.6% lower in September when compared with February 2020. “As lockdown eased, we saw an increase in travel and the quantity of fuel bought. However, as many people remained working at home and with certain restrictions still in place, fuel sales were yet to fully recover,” it added.Another positive contribution came from sales of spectacles and contact lenses, the ONS said.”We gained feedback from opticians in this sector, suggesting that pent-up demand for eye tests and optical wear increased their sales when lockdown measures had eased,” it added.The proportion of online sales was at 27.5%, compared with 20.1% reported in February.”There’s no doubting that UK consumers have been doing their bit to boost the economy, following a quarter of record retail sales growth,” said Lynda Petherick, head of retail at Accenture UKI.”There’s little time for retailers to gather breath, though, and they will already be wondering – or perhaps dreading – what lies ahead in Q4. “This should be a time for excitement as the crucial ‘golden quarter’ for retail is now underway. However, with lockdown measures across the UK tightening by the day, retailers are braced for a difficult and unconventional end to the year.”

Huawei 'forging forward' despite Trump sanctions

image copyrightGetty ImagesChinese phone maker Huawei said it was doing its best “to survive and forge forward” despite US sanctions.Huawei is one of a handful of Chinese tech firms targeted by Donald Trump on the grounds of national security.The phone maker had been busy stockpiling its supply of microchips before a US trade ban came into effect in September.On Friday, it said revenues for the first three quarters of 2020 were 9.9% higher than the same period last year.But Huawei said its ability to find component parts such as microchips has been “put under intense pressure and its production and operations saw increasing difficulties”. Huawei launches fresh phones despite chip freezeHuawei seeks own version of NHS Covid-19 app What is Huawei and why is it being banned? Disruptions in manufacturing caused by Covid-19 were also to blame.During January to September this year, Huawei generated 671.3bn Chinese Yuan ($100bn; £77bn) in revenue.Chips downThe US government put Shenzhen-based Huawei on its blacklist last year and put pressure on other countries to exclude Huawei from their next-generation 5G networks.The US now requires any company that sells Huawei products made anywhere with US technology to obtain a licence.Huawei said it was hopeful some chipmakers will apply for licences and was willing to work with partners to replenish its supplies.Going forward, Huawei said it would focus on technologies such as Artificial Intelligence (AI) and cloud “and unleash the value of 5G networks along with its partners”. On Thursday, Huawei unveiled its Mate 40 smartphones, claiming they feature a more “sophisticated” processor than Apple’s forthcoming iPhones.

'A big supermarket shop feels frivolous now'

image copyrightSiobhan WalkerSiobhan Walker has worked seven days a week for the last six weeks, and there’s still no day off on the horizon.Her partner Steve, a musician, lost most of his work when the pandemic hit, so as well as her main job as a financial assistant Siobhan works in the local petrol station a few evenings and at the weekend.Even so, they’re having to cut back to make ends meet.”I’m a big shopper. I like treating myself to beauty products, make-up and skincare,” says Siobhan. “I’ve had to rein it in.” Getting her nails and eyebrows done are out too.And the luxury of popping to the supermarket for a trolley-full like they used to strikes Siobhan as “a bit frivolous” now.”We’re more savvy with our shopping. Instead of Tesco and Morrisons, we’ll go to Aldi and Lidl or the market to get better deals,” she says.Households across the UK are tightening their belts as the economic consequences of the pandemic eat into incomes. And Blackpool, where Siobhan, 30, and Steve, 37, live, is one of the worst-hit areas. Since March the numbers looking for work in Blackpool have doubled to around 12% of the local population while job vacancies have fallen by more than a third.image copyrightGetty ImagesIncomes in Blackpool were already lower than almost anywhere else in the UK before the pandemic, meaning people are less likely to have savings to fall back on or friends and family in a position to help them out. Nevertheless, Siobhan and Steve are just managing to keep on top of things by taking payment holidays on their car finance and credit cards.Payment holidays: ‘I can’t afford to be out of work’Others haven’t been so fortunate. The government moved quickly in March to help protect incomes, increasing universal credit by £20 a week, launching loan schemes for the self-employed and paying businesses to put staff on furlough. But within that there remained a wide range of experiences. Furloughed workers took home on average 13% less than before, according to analysis by the Institute for Fiscal Studies. But those who lost their jobs and moved on to universal credit saw their incomes fall by an average of 40%. A survey released this week by the Financial Conduct Authority suggested that “12 million people in the UK had low financial resilience, meaning they may struggle with bills or loan repayments”.It suggested that almost a third of adults have seen a drop in income, with households seeing income fall by a quarter, on average.Rezia, 37, who lives in central London, estimates her family is living on around a half of what they had before the pandemic hit, after her husband lost his job as a carer in March.They are relying on the maintenance loan she gets as a full-time student, while he tries to earn some money “Ubering”. But London is still very quiet and business is slow.Residents of the UK’s biggest cities have been hit particularly hard as offices emptied out and the entertainment industry shut down.’I didn’t want to tell anyone I was claiming benefits”Most of our spending is on our son'”We’re trying to stick to a budget,” Rezia says.”It’s a massive change. No more treats, less snacks, and for meat, usually in an Asian household you do a monthly shop and put it in the freezer. Now we just go to the shop and get a little bit.”Rezia’s daughters have learned not to ask for toys, magazines and chocolate. The only concessions: she has kept her car and her husband has kept his gym membership.image copyrightReziaThe biggest change is to their social lives, Rezia says.”Before we would go to restaurants, have takeaways, go shopping for presents. We used to go to my mum’s house with cakes and treats and take her out for coffee or shopping.”At Eid she says the four of them had a picnic in St James’s Park instead of the big family celebration that would have been more typical.Siobhan and Rezia’s belt-tightening illustrates one half of the parallel narratives affecting overall spending, says Dave Innes, chief economist at poverty campaign group, the Joseph Rowntree Foundation.”We have a striking contrast,” he says. “If you were someone towards the bottom of the income distribution you’re more likely to have had a difficult experience,” he says.”People in the middle or top of the income distribution have been more likely to continue working from home and during lockdown built up savings, and generally are a lot less likely to be in a bad financial position.”‘Lockdown was madness at home but saved us financially’People saving more but get little in returnOf course some better-off individuals are the ones who have seen the most dramatic falls in income, if they lost well-paid jobs or had to close their businesses. But they are also more likely to have assets to fall back on, says Mr Innes.image copyrightDonia YoussefDonia Youssef, for instance, has seen her business Tiny Angels, a modelling and casting agency for children based in London, grind to a standstill with no prospect of reopening for the foreseeable future. She has taken her young children out of private school, cancelled holidays and sold cars.”It has just put huge pressure on us, so I said to the family let’s reroute and rent out this house or sell it and go to St Lucia,” she says. Her husband, who has just been laid off from his job, is from St Lucia and Donia can pursue her other business interests in publishing and film almost as easily from there as here.”We said let’s try it for a year. There’s nothing to lose. If it doesn’t work we’ve got rentals in the UK we can live off,” she says.Aisling and Jamie Lord, both 40, aren’t quite so fortunate. They both lost their jobs and are now claiming universal credit, about £1,000 a month.Before this summer, they took home eight times that between them, through her work in human resources, and his as a customer experience manager.They’ve cancelled the children’s football clubs, maths tutors, swimming lessons and cut out having wine with dinner. Instead of buying Halloween decorations they’ll be making them out of whatever is in the recycling box.”A treat before would have been going to a toy store. We wouldn’t have blinked an eye if [our daughter] had picked up a doll for £25. Today a treat is a chocolate lollipop,” says Aisling.Despite cutting back on everything they can think of their outgoings are more than their income every month, but luckily, they had savings to fall back on.Moreover they live in a part of the country, just west of London, where they are hopeful they’ll be able to find new jobs thanks to flourishing pharmaceutical and technology industries. But even when they are back in work, they aren’t planning to return to their pre-pandemic spending habits.”To be honest it’s been a great financial lesson. It has made us make our pennies go a lot further,” says Aisling.Now she says they’re actually a bit frightened of spending again. “We just need to get money and save for the next rainy day. The world has broken once and will break again. We need to hold on to our money.”

The apps promising to improve your sex life

image copyrightSam StricklandThis article discusses adult issues involving sex and relationships.When Sachin Raoul, 27, encountered a sexual issue following a break-up three years ago, it led to him feeling “distressed”.”It was frustrating not to have control over my body. I really wanted it to behave in a certain way but it was difficult,” he adds.While Mr Raoul sought help through therapy, he admits that at around £100 per session it was tough on the wallet.However, it did push the entrepreneur to try and find a way to make therapy more accessible, leading him to partner with therapist Dr Katherine Hertlein and co-found Blueheart, a free app designed to help individuals and couples combat sex-related issues. It uses a mixture of audio and text-based sessions focused on areas such as building a positive relationship with your body and communication.”We want to eradicate the stigma associated with sexual dysfunction by providing an app which acts as a safe space for people to address the issues they are having,” says Mr Raoul, who is based in London.”I could only dream of something like Blueheart existing three years ago. I was willing to jump into anything I could find.”How Blueheart got off the groundFrom erectile problems to low libido, many people are unhappy with their sexual wellbeing. A 2017 survey by counselling organisation Relate found that only a third (34%) of UK adults are satisfied with their sex lives, while 32% have experienced a sexual problem. Erectile dysfunction (ED) remains a major issue, with research reporting that more than 322 million men are expected to suffer from ED by 2025.While there’s been a proliferation of apps emerging in areas such as mental health and fitness, sexual wellness has long been ignored despite so many people feeling dissatisfied with their sex life. However, a rising number of start-ups are looking to change this.image copyrightLoverLast year Dr Britney Blair, a clinical psychologist and behavioural medicine expert, co-founded sexual wellness app Lover. It describes itself as a science-based app for addressing sexual concerns, increasing pleasure and improving skills in the bedroom. It looks to take on such areas by a series of practical exercises such as orgasm exercises, mindfulness and games through a mix of audio and video content.One of its courses focuses on erections – a 23-day programme featuring a variety of different exercises and techniques. The company found that 62% of the 600 men who took part in a three-week trial reported improvements in their erections.Through her clinic in San Francisco, Dr Blair treats clients with issues such as the inability to climax, painful sex, erectile dysfunction and low desire.More Technology of BusinessThe forklift truck drivers that never leave their desksNew jets promise to revive supersonic travelCreating fuel from thin air with artificial leavesCar makers compete to keep you entertainedThe robot shop worker controlled by a faraway human”Therapy can change people’s lives,” she says. “Sexual health is very important and I see relationships changed and lives changed through the work I do [face to face]. Now we have tech as a digital intervention.”The tech means they can reach more people. “The grand plan is we help people to optimise their sexual life and make sure sex stays alive. Sexual disconnection is a reason couples get divorced.”Lover is free but you can pay a monthly or annual subscription for additional premium content.Another app making waves is Ferly, an audio app and guide to mindful sex, launched by founders Billie Quinlan and Dr Anna Hushlak last year. The app brings together audio erotic stories, guided practices and personalised programmes to help women explore pleasure in a more mindful way and overcome sexual issues.image copyrightFerlyMs Quinlan says the founders wanted to create a platform that would “tackle a taboo topic”. She adds: “It’s not about the sexualisation of sex or sex toys. It’s about sexual wellness. Sexual health is another really critical pillar of health that’s often neglected until it needs confronting.”The app takes users through different programmes addressing issues such as lack of body confidence, low libido, and the inability to have an orgasm.”We use a mindful cognitive behavioural therapy approach,” explains Ms Quinlan. “Many sexual issues are because there’s a physiological barrier. You can’t take a pharma approach… you have to take a holistic approach.”Like Lover, Ferly is free but charges for premium content.One user, based in Edinburgh, turned to the app after her sister recommended it. “I was assaulted when I was a teenager and I didn’t have a good relationship around female pleasure. I found it kind of stressful and upsetting for various reasons,” she says.She used the app while also seeking therapy. “I held back a bit during therapy but the app gave me my own space to reflect. It helped me recognise a lot of emotions and it was good for the healing process. It also made me feel better about what I would feel comfortable asking or expecting from a partner. It gave me more confidence.”image copyrightBlueheartLike many mental health and fitness apps, the start-ups reported an increase in visits during lockdown. “It showed us that people were starting to evaluate their health and that sexual wellness is an important part of that,” says Ms Quinlan.Blueheart’s Sachin Raoul echoes one of the positive knock-on effects of Covid-19. “Lockdown pronounced parts of people’s lives and made people take care of their mental health,” he says.Silva Neves, a psychosexual and relationship psychotherapist and couples therapist, says he is really “pro-technology” and can reel off the benefits of such apps, especially for those who can’t afford therapy, but he warns people to do their research before downloading.”Some platforms are better than others,” he advises. “Don’t just go to Google and find anything. It’s good to be directed by others. Some apps will have just sprinted to market and offer a poor service. Look at the names and backgrounds of the people behind the apps. You want people who are experts in sexology and have qualifications.”With the digitalisation of the sector, can the apps replace human intervention with a sex therapist?”There’s a place for both,” says Mr Raoul.”People have different preferences. Some people are extremely shy and would never talk about their sexual issues with someone. Plus not everyone can afford therapy.”Lover’s Dr Britney Blair adds there will be always be a place for doctors working with patients in the office. “We are not going to create an app that is the same as talking in the office. We are not trying to.”People talk about sleep and mental health but no-one is talking about sex. About 20% of people [with sexual issues] actually need intervention with a sex therapist but if we can help 80% with their sexual problems, then I’ll take it.”