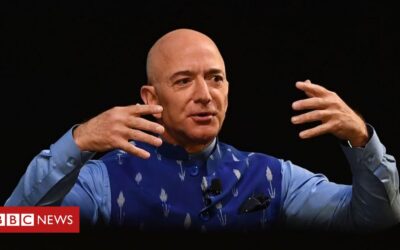

Billionaires have seen their fortunes hit record highs during the pandemic, with top executives from technology and industry earning the most. The world’s richest saw their wealth climb 27.5% to $10.2trn (£7.9trn) from April to July this year, according to a report from Swiss bank UBS.That was up from the previous peak of $8.9trn at the end of 2017 and largely due to rising global share prices. UBS said billionaires had done “extremely well” in the Covid crisis.It also said the number of billionaires had hit a new high of 2,189, up from 2,158 in 2017.It comes as a World Bank report on Wednesday showed extreme poverty is set to rise this year for the first time in more than two decades due to the pandemic.Rising demand Among the billionaires, the biggest winners this year have been industrialists, whose wealth rose a staggering 44% in the three months to July. “Industrials benefited disproportionately as markets priced in a significant economic recovery [after lockdowns around the world],” UBS said. China’s new richest person is a bottled water tycoon

Inventor Sir James Dyson tops UK Rich List

Tech billionaires have also had a good pandemic, seeing their wealth soar 41%. UBS said this was “due to the corona-induced demand for their goods and services” and social distancing accelerating “digital businesses [and] compressing several years’ evolution into a few months”.Healthcare billionaires also benefited as the crisis put drug makers and medical device companies in the spotlight.The rise in fortunes reflects the generally strong performance of global stock markets since late March, despite most countries continuing to suffer sharp recessions. Amazon boss Jeff Bezos and Tesla founder Elon Musk – both multi-billionaires – saw their wealth hit new highs this summer thanks to growth in the price of their companies’ stock. Global changeIn the last 11 years China’s billionaires have increased their wealth by the biggest percentage, climbing 1,146% between 2009 and 2020, according to UBS.By comparison, over the same period the wealth of British billionaires has risen by just 168%.But the biggest accumulation of wealth remains in the US where American billionaires have $3.5trn, compared to China’s $1.7trn.The UK’s wealthy have just $205bn, compared to Germany’s $595bn and France’s $443bn.DonationsUBS said many billionaires had donated some of their wealth to help with the fight against Covid-19.”Our research has identified 209 billionaires who have publicly committed a total equivalent to $7.2bn from March to June 2020,” the report said. “They have reacted quickly, in a way that’s akin to disaster relief, providing unrestricted grants to allow grantees to decide how best to use funds.”But it revealed that UK billionaires donated less than those from other countries. In the US, 98 billionaires donated $4.5bn, in China 12 billionaires gave $679m, and in Australia just two billionaires donated $324m. But in the UK, nine billionaires donated just $298m.

BBC Business News Articles

Bounce back loans: Taxpayers may lose £26bn on unpaid loans

Up to 60% of emergency pandemic loans made under the Bounce Back scheme may never be repaid, a report by the government’s spending watchdog says. The National Audit Office (NAO) said taxpayers could lose as much as £26bn, from fraud, organised crime or default.The lending scheme carried lighter checks than others and was aimed at small businesses unable to access other pandemic funding support.A recent BBC investigation revealed how fraudsters were using the loan system. Many of those affected will have no idea their names have been used until repayment letters begin arriving in early summer.One of the victims spoken to by the BBC, Mark Telling, said he was worried “to death” to discover a company set up in his name by a criminal had “borrowed” £50,000 from the bail-out scheme. The BBC also spoke to Sue Burden, who had also found her identity had been stolen to set up a bogus company to access the scheme. She said she had gone “from tears to anger… now I’m going to be scared to do anything”.The BBC reported last week that the government was warned back in May that the scheme was at “very high risk of fraud” from “organised crime”.The government said it has tried to minimise fraud through lenders’ background checks. ExtensionThe scheme provides firms with 100% government-backed finance worth up to £50,000.Demand has been greater than anticipated, and the total value of these loans is now expected to be £38bn-£48bn, up from an estimate of £18bn-£26bn.They do not have to be paid off for 10 years and offer a range of flexible payment options. The loan scheme is an extension of earlier offers which some businesses complained they could not access as the lending criteria was too strict. The NAO report warned that the speed with which the scheme was rolled out heightened the fraud risk. It took a month to ensure businesses could not receive more than one loan. The Public Accounts Committee said it was the government’s largest and most risky business support scheme. It says it will not assess the value-for-money of the scheme, as the loans will not start being paid back until May next year. The NAO analysis said losses from the scheme are likely to reach “significantly above” normal estimates for public-sector fraud of 0.5% to 5%. The report also said the UK’s five biggest banks will make nearly £1bn between them from the scheme.’Taxpayer’s expense’Meg Hillier, chair of the Public Accounts Committee, said the loans had been a vital lifeline for many businesses. But she added that “the government estimates that up to 60% of the loans could turn bad – this would be a truly eye-watering loss of public money”. “The bounce back loan scheme got money into the hands of small businesses quickly, and will have stopped some from going under.”But the scheme’s hasty launch means criminals may have helped themselves to billions of pounds at the taxpayer’s expense.”Sadly, many firms won’t be able to repay their loans and the banks will be quick to wash their hands of the problem. Analysis: Angus Crawford, BBC news correspondent Today’s report confirms what many people had suspected. In May, the government had to get money to small businesses as quickly as possible, before tens of thousands of them went bust. But to do that, they had to make compromises on credit and fraud checks. This opened the doors to a whole range of problems – including fraud by organised criminal gangs. We’ve found evidence of more than 100 bogus firms set up by scammers to make fraudulent applications – getting the maximum £50,000 each time. They’ve used the stolen, personal details of innocent victims to set up the fake companies – victims who won’t know anything about it until the letters demanding repayment start arriving through their doors next summer. How it’s done: Gangs steal victims’ personal details using phishing emails or buying them on criminal forums.

They then set up a bogus business in their name.

After opening a business bank account they then apply for a Bounce Back Loan through the same bank.

The taxpayer is in the same position – waiting to find out how much the scheme will ultimately cost us. The warning from the National Audit Office is clear – it has the potential to be “very high”.Sue and Dave Burden, from the south of England, were shocked to find that Sue’s identity had been stolen to set up a company and claim a bounce back loan. “I’ve gone from tears to anger,” she told the BBC. “Now I’m going to be scared to do anything.”The state-owned British Business Bank (BBB), which supervises the bounce back loan scheme, twice raised concerns, firstly in May. The BBB expects it will pay out £1.07bn in interest payments to the high street lenders that provided the cash. Most of this will go to UK’s five biggest banks, Barclays, HSBC, Lloyds, NatWest and Santander, which provided £31.3bn of funding.According to latest Treasury figures, there have been 1.55 million applications for the loans, with 1.26 million approvals.”We targeted this support to help those who need it most as quickly as possible and we won’t apologise for this,” a government spokesperson said.”We’ve looked to minimise fraud – with lenders implementing a range of protections including anti-money laundering and customer checks, as well as transaction monitoring controls. “Any fraudulent applications can be criminally prosecuted for which penalties include imprisonment or a fine or both.”Have you been affected by the issues raised in this story? Share your experiences by emailing [email protected] include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:WhatsApp: +44 7756 165803

Tweet: @BBC_HaveYourSay

Please read our terms & conditions and privacy policy

If you are reading this page and can’t see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at [email protected]. Please include your name, age and location with any submission.

Bounce back loans: Taxpayers may lose £26bn on unpaid loans

Up to 60% of emergency pandemic loans made under the Bounce Back scheme may never be repaid, a report by the government’s spending watchdog says. The National Audit Office (NAO) said taxpayers could lose as much as £26bn, from fraud, organised crime or default.The lending scheme carried lighter checks than others and was aimed at small businesses unable to access other pandemic funding support.A recent BBC investigation revealed how fraudsters were using the loan system. Many of those affected will have no idea their names have been used until repayment letters begin arriving in early summer.One of the victims spoken to by the BBC, Mark Telling, said he was worried “to death” to discover a company set up in his name by a criminal had “borrowed” £50,000 from the bail-out scheme. The BBC also spoke to Sue Burden, who had also found her identity had been stolen to set up a bogus company to access the scheme. She said she had gone “from tears to anger… now I’m going to be scared to do anything”.The BBC reported last week that the government was warned back in May that the scheme was at “very high risk of fraud” from “organised crime”.The government said it has tried to minimise fraud through lenders’ background checks. ExtensionThe scheme provides firms with 100% government-backed finance worth up to £50,000.Demand has been greater than anticipated, and the total value of these loans is now expected to be £38bn-£48bn, up from an estimate of £18bn-£26bn.They do not have to be paid off for 10 years and offer a range of flexible payment options. The loan scheme is an extension of earlier offers which some businesses complained they could not access as the lending criteria was too strict. The NAO report warned that the speed with which the scheme was rolled out heightened the fraud risk. It took a month to ensure businesses could not receive more than one loan. The Public Accounts Committee said it was the government’s largest and most risky business support scheme. It says it will not assess the value-for-money of the scheme, as the loans will not start being paid back until May next year. The NAO analysis said losses from the scheme are likely to reach “significantly above” normal estimates for public-sector fraud of 0.5% to 5%. The report also said the UK’s five biggest banks will make nearly £1bn between them from the scheme.’Taxpayer’s expense’Meg Hillier, chair of the Public Accounts Committee, said the loans had been a vital lifeline for many businesses. But she added that “the government estimates that up to 60% of the loans could turn bad – this would be a truly eye-watering loss of public money”. “The bounce back loan scheme got money into the hands of small businesses quickly, and will have stopped some from going under.”But the scheme’s hasty launch means criminals may have helped themselves to billions of pounds at the taxpayer’s expense.”Sadly, many firms won’t be able to repay their loans and the banks will be quick to wash their hands of the problem. Analysis: Angus Crawford, BBC news correspondent Today’s report confirms what many people had suspected. In May, the government had to get money to small businesses as quickly as possible, before tens of thousands of them went bust. But to do that, they had to make compromises on credit and fraud checks. This opened the doors to a whole range of problems – including fraud by organised criminal gangs. We’ve found evidence of more than 100 bogus firms set up by scammers to make fraudulent applications – getting the maximum £50,000 each time. They’ve used the stolen, personal details of innocent victims to set up the fake companies – victims who won’t know anything about it until the letters demanding repayment start arriving through their doors next summer. How it’s done: Gangs steal victims’ personal details using phishing emails or buying them on criminal forums.

They then set up a bogus business in their name.

After opening a business bank account they then apply for a Bounce Back Loan through the same bank.

The taxpayer is in the same position – waiting to find out how much the scheme will ultimately cost us. The warning from the National Audit Office is clear – it has the potential to be “very high”.Sue and Dave Burden, from the south of England, were shocked to find that Sue’s identity had been stolen to set up a company and claim a bounce back loan. “I’ve gone from tears to anger,” she told the BBC. “Now I’m going to be scared to do anything.”The state-owned British Business Bank (BBB), which supervises the bounce back loan scheme, twice raised concerns, firstly in May. The BBB expects it will pay out £1.07bn in interest payments to the high street lenders that provided the cash. Most of this will go to UK’s five biggest banks, Barclays, HSBC, Lloyds, NatWest and Santander, which provided £31.3bn of funding.According to latest Treasury figures, there have been 1.55 million applications for the loans, with 1.26 million approvals.”We targeted this support to help those who need it most as quickly as possible and we won’t apologise for this,” a government spokesperson said.”We’ve looked to minimise fraud – with lenders implementing a range of protections including anti-money laundering and customer checks, as well as transaction monitoring controls. “Any fraudulent applications can be criminally prosecuted for which penalties include imprisonment or a fine or both.”Have you been affected by the issues raised in this story? Share your experiences by emailing [email protected] include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:WhatsApp: +44 7756 165803

Tweet: @BBC_HaveYourSay

Please read our terms & conditions and privacy policy

If you are reading this page and can’t see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at [email protected]. Please include your name, age and location with any submission.

PureGym personal trainer sorry for 'very ill-judged' slavery post

PureGym called it “wholly unacceptable” at the time, on Monday, and has not commented further.

Tesco profits surge as online orders double

Supermarket giant Tesco has seen first-half profits rise by more than a quarter as customers bought more food during the pandemic and online orders doubled.Pre-tax profit for the 26 weeks to 29 August was £551m, 28.7% up on 2019.It is Tesco’s first set of results under its new chief executive, Ken Murphy, who started last week.He replaces Dave Lewis, who had been running the UK’s biggest retailer since 2014.With more customers turning to online shopping, Tesco more than doubled delivery capacity to 1.5 million slots a week during the first half, including serving 674,000 vulnerable customers. While demand for food rose, clothing fared less well, with sales down 17.2%.Like many of its rivals, Tesco was forced to overhaul its strategy in-store and online amid the coronavirus lockdown.Mr Murphy told a conference call with journalists the first half of this year had “tested our business in ways we had never imagined”, but employees had “risen brilliantly to every challenge”.He said he felt “very comfortable in my own skin and my ability to lead this business”.”I’m really happy with the strategy and direction of the company,” he added. “My job is to maintain momentum in the business and deliver a fantastic Christmas.”Tesco is in the process of selling its businesses in Thailand, Malaysia and Poland, but Mr Murphy said there was currently “no plan for further retrenchment”.When Dave Lewis was parachuted into the top job in Tesco in 2014, the business was in crisis. Now Ken Murphy is presiding over his first set of results and Britain’s biggest retailer is doing rather well. The business, he says, is in “great shape”. But his job is going to be far from easy. He’s got to steer Tesco through the ongoing Covid-19 crisis during the key festive trading period. Then there’s the impact of a potential no-deal Brexit looming on the horizon. And as the job losses start to mount, shoppers’ budgets will be coming under increasing pressure. The battle for our wallets is set to become even more intense. Finally, now that Tesco’s turnaround is complete, Mr Murphy will have to focus in the longer term on how to grow the business. A new chapter begins. Operating profit figures told a different story, however, falling 15.6% to £1.037bn. One of the items dragging down the balance sheet was Tesco Bank, which made a loss of £155m.Tesco said sales in the UK and Ireland rose 8.6% to £24.3bn, with overall revenue of £28.7bn. But it added that coronavirus-related costs had hit £533m.UK food sales went up 9.2% during the period, the retailer said.Ocado takes Tesco’s most valuable retailer slot

Tesco targets 300% rise in vegan meat sales

The supermarket said it was increasing its interim dividend by 21% to 3.2p a share.It also named a new chief financial officer, Imran Nawaz, who is joining from Tate & Lyle. He will succeed Alan Stewart, who is retiring in April.”In spite of these positive results, Tesco will still have concerns after its valuation dropped below Ocado,” said Julie Palmer, partner at Begbies Traynor.And even though Dave Lewis had left “a well-oiled machine” behind him, it would not be an easy ride for Mr Murphy as the new chief executive, she added.”Facing a pandemic, an economic recession and an exit from the EU all at once is not the ideal recipe for success in anyone’s book. “However, add in growing competition from challenger brands such as Aldi with a new click-and-collect service, the M&S partnership with Ocado and the looming juggernaut of Amazon entering the field of play, and getting through this period with its position intact will be no mean feat.”

Unexplained Wealth Orders: Suspected money launderer gives up £10m of property

Around £10m of property has been surrendered in a major victory against some of northern England’s most dangerous criminals.The apartments and homes were given up to the National Crime Agency by a Leeds businessman who investigators suspect of being a major money-launderer. The NCA says Mansoor Mahmood Hussain acted for gangsters, including a murderer and drug trafficker.The agency believes he laundered their profits through a property empire. Over two decades, Mr Hussain, known as Manni, developed his portfolio across West Yorkshire, Cheshire and London while posing as a legitimate businessman. His social media accounts show him living a luxury lifestyle involving high-performance cars, executive jets, super-yachts and appearances at VIP events attended by celebrities. He filled his timeline with pictures of the famous – although there is no suggestion that any of VIPs he posed with knew who he was. While the 40-year-old has never been convicted of a crime, investigators say they had intelligence linking him to serious gangsters – but could not obtain the detailed evidence needed for charges of money laundering. Instead, in 2019, they turned to the relatively new power of an Unexplained Wealth Order which required the businessman to open his books and show how his wealth had come from legitimate sources.The NCA has now announced that Mr Hussain has given up fighting the case against him and has agreed a settlement in which he has handed over the vast majority of his empire – 45 properties, apartments, offices and homes. The settlement also includes the brand name Poundworld, which Mr Hussain bought after the original chain’s demise. As part of the settlement, the NCA has left him with four small properties that are still mortgaged, and cash in a bank account that was not part of the original investigation. Graeme Biggar, head of economic crime at the NCA, said: “This case is a milestone, demonstrating the power of Unexplained Wealth Orders, with significant implications for how we pursue illicit finance in the UK.”This ground-breaking investigation has recovered millions of pounds worth of criminally-obtained property. “It is crucial for the economic health of local communities such as Leeds, and for the country as a whole, that we ensure property and other assets are held legitimately.”The biggest single property handed over to the NCA is a high-specification apartment and office development, Cubic, on the outskirts of Leeds, which Mr Hussain wholly owned through one of his many companies.The other properties include a home on one of the city’s most expensive roads, an apartment opposite Harrods in London and terraced housing in Leeds and Bradford. Once all the property is eventually sold, the profits will be split 50/50 between the investigatory agency and central government. In High Court legal papers, the NCA said it believed the seed money for Cubic’s development and other property purchases must have come from Mr Hussain’s criminal associates because they could find no legitimate source for his wealth. He had paid virtually no income tax in some years and many of his 77 companies were dormant. The court was told Mr Hussain was thought to be a “clean skin” – a businessman free of convictions, acting as a professional money-launderer. Today the NCA said one of the developer’s closest associates was Bradford gangster Mohammed Nisar Khan, known on the street as “Meggy”. Last year he was jailed for life for murder – and investigators have long considered him one of the most significant organised crime bosses in northern England, involved in drug and firearms trafficking operations. Mr Hussain has been close to Mohammed Khan since 2005 and frequently drove him to and from court, according to evidence gathered by investigators. He also paid a £134,000 confiscation order for Khan’s brother, Shamsher, who had been separately convicted of money laundering. The NCA also said that Dennis Slade, who once headed an armed robbery gang, stayed rent-free in Mr Hussain’s seven-bedroom Leeds home – one of the properties he’s now surrendered. The highly unusual outcome of the investigation – including the settlement leaving the target with some property – comes after the future of the UWO powers was in doubt. Of the four cases launched since the orders were created, two are still being fought through the courts while the NCA lost the third after the High Court ruled the individuals being targeted had no case to answer. The NCA today defended the decision to settle the Hussain case, saying Manni Hussain had been left with virtually nothing other than heavily mortgaged properties – and it had saved the taxpayer time and money by discouraging him from launching a potentially long and expensive legal battle. Investigators say that the settlement included no promise to Mr Hussain that he would not be investigated again in the future. Duncan Hames of Transparency International, an anti-corruption and white collar crime campaign group that lobbied for the introduction of UWOs, welcomed the outcome of the case. “What’s important is that there is a high level of transparency so people can see justice being done,” said Mr Hames. “Given the challenges on the court system, we need to be grateful when cases are brought to a conclusion – but we need to see many more of them.”The BBC has attempted to contact Mr Hussain for comment.

US tech giants accused of 'monopoly power'

A report backed by Democratic lawmakers has urged changes that could lead to the break-up of some of America’s biggest tech companies.The recommendation follows a 16-month congressional investigation into Google, Amazon, Facebook and Apple.”These firms have too much power, and that power must be reined in,” Democratic lawmakers working on the probe wrote. But Republicans involved in the effort did not agree with the recommendations.In a statement, one Republican congressman Jim Jordan dismissed the report as “partisan” and said it advanced “radical proposals that would refashion antitrust law in the vision of the far left.” Others have said they support many of the report’s conclusions about the firms’ anti-competitive tactics but that remedies proposed by Democrats go too far.”Antitrust enforcement in Big Tech markets is not a partisan issue,” said Republican Ken Buck. “But an ounce of prevention is worth a pound of cure—I would rather see targeted antitrust enforcement over onerous and burdensome regulation that kills industry innovation.”Monopoly power?US tech companies have faced increased scrutiny in Washington over their size and power in recent years. The investigation by the House Judiciary Committee is just one of multiple probes firms such as Facebook and Apple are facing.The 449-page report, penned by committee staff, accused the companies of charging high fees, forcing smaller customers into unfavourable contracts and of using “killer acquisitions” to hobble rivals. “To put it simply, companies that once were scrappy, underdog startups that challenged the status quo have become the kinds of monopolies we last saw in the era of oil barons and railroad tycoons,” it said. It said the findings should prompt politicians to consider a series of changes. Those included stronger enforcement of existing competition law, as well as changes to limit the areas in which a firm may do business or prevent companies from operating as players in areas where they are the dominant provider of infrastructure – as Amazon does, for example, when it acts as both a seller and marketplace for other merchants. This report is blockbuster. It carries heft too – it’s stacked with evidence collected over 16 months. But the key thing here is these are Democrat suggestions. This is not a bi-partisan set of recommendations. In fact, from what we’ve already heard from Republicans many of the recommendations are “non-starters” for conservatives. It’s also been reported that some Republicans were angered by omissions in the report. Republicans wanted sections on alleged anti-conservative bias – which was apparently blocked by Democrats. There are, however, Republicans who want to find common ground on antitrust. For example, Republican Ken Buck has indicated he’d support some of the recommendations. For example, shifting the anti-competition burden of proof for acquisitions – making it more difficult to buy up the competition. In truth though, we’re unlikely to see any concrete legislative proposals until after the election. But what’s now crystal clear is both Biden and Trump – in their own different ways – offer existential challenges to the power of Big Tech. Read more from James’Fringe notions’In testimony before the committee in July, the bosses of tech firms defended their actions.On Tuesday, Amazon hit back at what it described as “fringe notions of anti-trust” law, as competition law is known in the US.”The fact that third parties having the opportunity to sell right alongside a retailer’s products is the very competition that most benefits consumers and has made the marketplace model so successful for third-party sellers”, the company said in a blog post.Divisions in Washington between Republicans and Democrats make the prospects of significant action against the firms unlikely, tech analyst Dan Ives of Wedbush Securities said. “The lack of consensus and divergence among both sides of the aisle on the antitrust issues remains a major issue to move things forward,” he said.While that could change if Democrats gain more power in the upcoming US election, he said, “Despite the report/content and framework for recommendations around Big Tech players (e.g. M&A, business practices) without core law changes we believe this antitrust momentum hits a brick wall.”In response, Facebook said in a statement: “Instagram and WhatsApp have reached new heights of success because Facebook has invested billions in those businesses. “A strongly competitive landscape existed at the time of both acquisitions and exists today. Regulators thoroughly reviewed each deal and rightly did not see any reason to stop them at the time.”What did the report say?Facebook had “monopoly power” in the market for social networking, which it maintained by using its data advantage to “acquire, copy or kill” nascent threats.

Google monopolised online search and advertising using “a series of anti-competitive tactics”, including privileging its own content ahead of other websites.

Amazon possessed “significant and durable market power” in online shopping, which it furthered in part by “anticompetitive conduct in its treatment of third-party sellers” which it referred to as “internal competitors” behind closed doors.

Apple exerted monopoly power via its App store,which it leveraged “to create and enforce barriers to competition and discriminate against and exclude rivals while preferencing its own offerings”.

Phone bill charges of £1,200 added 'without permission'

“I was absolutely horrified and I actually felt quite violated”.That’s how Sally Giles describes the moment she discovered she’d been charged £4.50 each week, every week for more than five years “without [her] knowledge or permission”.The charge – which totalled more than £1,200 – was added to her phone bill by her provider, EE, allowing her to take part in a competition run by Xinion, owned by BMCM Group.Xinion says Sally signed up to their service in July 2015.”They haven’t given me any proof whatsoever that I signed up. They insist I must have gone onto a website and entered my phone number. I have never, ever done that. I would never do something like that.”Sally says she only found out about the charge when she called her provider about a different query in September 2020 – and the adviser asked her if she knew about this weekly charge she’d been paying for so many years.”I don’t gamble, I don’t even buy a lottery ticket so no, [I didn’t sign up],” she says.”The proof is I have never played the game, why would I pay £4.50 a week and never play the game?”‘Extra charges’Sally says she did occasionally check her phone bill, but the extra charges weren’t clearly defined so she assumed they were charity donations she made or when she bought more data.Xinion did send Sally a text each week though asking her a competition question which also explained she was being charged, but she just thought it was a spam text message.”You have to open the text to see you’re being charged,” she says. “I don’t open texts from unknown sources for obvious reasons because that’s what you’re told all the time. ‘Do not click on links you don’t recognise, just delete it straight away’.”When I realised what was happening I opened [the text] and at the bottom, right at the bottom, if you scroll down it says you are being charged £4.50. But as I say you have to open the text to see it.”Paul Muggleton, founder of the Phone-paid Services Consumer Group says it’s irrelevant whether or not people technically sign up – what matters is whether or not people have knowingly signed up for a service.”People who are tricked into, or who unwittingly sign up to a contract, are not bound by the terms of that contract. That’s basic consumer law. People have to know what they’re getting into.”The burden of proof always rests with the third party service provider to show that consumers knowingly signed up.”For example, if someone has never once taken part in one of these text message competitions but has been charged, the likelihood is if it ever got to court they would be able to get their money back by showing they didn’t even know they’d been signed up.”Thousands of complaintsAfter finding out what happened Sally got in touch with the company involved, Xinion, explained her situation and asked for her money back. It refused.Then she got in touch with the regulator, the Phone Paid Services Authority, or PSA. “When I rang them originally I got a very lackadaisical reply saying we’ll look into it saying it might take months or even a year. I personally don’t think that’s good enough. It’s time the PSA got their act together.”The next step was the small claims court, but before that Sally got in touch with Money Box.We started digging and discovered there have been thousands of complaints to the regulator about these types of charges over the last few years.We also heard from Sally’s mobile phone provider, EE. It told us it had been in touch with Xinion and that as a gesture of goodwill Xinion had changed its mind and decided to refund Sally after all.The PSA said no-one was available for an interview but instead told us how it tightened up regulations on these subscription services last November and since then the number of complaints has dramatically reduced.However, the new regulations do not apply retrospectively, so people who may have found themselves signed up to similar “competitions” before the changes came into effect haven’t got that extra protection.We never heard back from Xinion, but EE said it’s toughened up its own procedures on these subscription services including making customers’ bills clearer, going above and beyond what the regulator requires.You can hear more on BBC Radio 4’s Money Box programme by listening again here.Follow Money Box and Dan on Twitter.

Victory in battle against 'thuggish' debt letters

“You get these letters and they make you bury your head even further – and that makes both your mental health and your debt problems worse,” Mrs Edwards, from Bridgend, told BBC News in June.

CEO Secrets: The graduates launching start-ups in lockdown

Media playback is unsupported on your device

As part of our CEO Secrets series, which invites entrepreneurs to share their advice, we are focusing on businesses that have launched during lockdown. Each week we will look at a different type of lockdown entrepreneur. We begin with recent graduates.Student friends Joshua Barley, Sonny Drinkwater and Kieran Fitzgerald, all aged 22, realised the job market would be tough for new graduates, as the huge impact of coronavirus became clear in March and April.Joshua and Sonny are old school friends. Joshua met Kieran at the University of Birmingham, introducing him to Sonny, who studied at Bristol.The three final-year students saw work placements and graduate scheme opportunities disappear in the spring. Job interview processes would draw to an early close, says Sonny.So they decided to take matters into their own hands and started a company, pooling their abilities and expertise. Both Joshua and Sonny had studied nutrition, while Kieran had been working on the benefits of gift exchange in the workplace as part of his end-of-year project.They combined these interests to focus on what was clearly becoming an important new fact of life: working from home. The trio created the company Snackcess, to provide gift boxes of healthy snacks for businesses to post to employees working at home.The box contains high-end, healthy, branded snacks, the kind that you might find in organic food stores.The team negotiate lower prices by buying directly from the manufacturers. When they started in July they sold five boxes. That increased tenfold in August and in September they sold 800 boxes, with a turnover of more than £9,000.Originally they did the packing themselves in Sonny’s parents’ garage in Kent. They have now hired their first employee, a “chief packer”.Large corporate clients include HSBC, Iress and Lululemon.BBCDo something every day that can make your idea seem a bit more realThe success has resulted in a dilemma for the team. It was never meant to be a permanent venture, rather they thought of it as a stop-gap, until the economy picked up again and they could find other jobs, explains Sonny.“That’s all changed now,” he says. “We’ve had such a big growth, we’re going to try and see this through.”Joshua adds: “We see this as a long-term opportunity for us now.”Kieran, meanwhile, has found a graduate placement with HSBC – but reluctant to completely leave the company he helped to found, he is remaining involved in a lesser capacity.For all three, it’s been a massive learning curve.“My advice is just do one small thing every day that makes your business idea more real, whether that’s setting up a meeting, or building a prototype,” says Sonny. “And don’t be afraid to network,” adds Kieran. “Just message people on LinkedIn, you’ll be surprised who gets back to you.”Despite the uncertainty of lockdown, many people have taken the opportunity to start their own company.Almost 50% more businesses were created in June 2020 than in June 2019, according to the Centre for Entrepreneurs. July set a new record with more than 81,000 businesses registered.There is no hard data on how many of these companies have been started by new graduates. But anecdotally, many final-year students faced with fewer opportunities like entry schemes and internships, have decided to be their own boss instead.Josephine Philips, 23, says she always had “an entrepreneurial gene”. She showed it from her first year of university, studying physics and philosophy at King’s College London. She made a tidy sum selling second-hand clothes on the popular Depop app.But while doing that she nurtured the idea of creating her very own digital fashion platform. She envisioned a “Deliveroo-like service, but for altering vintage clothes”. The concept stemmed from her own experience.She would often spy a piece of clothing she adored in a vintage shop, but wished it could have a small alteration either to mend it, or give it a more fashionable twist, and didn’t have good enough sewing skills to do this herself.When lockdown struck in March, she initially put her business idea on hold – but then she realised something.“All the restaurants were shutting down, but the thing that was keeping them alive was Deliveroo. What I proposed would allow seamsters to keep getting orders in a contact-free way.”Her business is called Sojo and employs a team of cyclists to collect clothes from people’s homes and take them to and from sewing shops for alterations. It is focusing on west London for now. Judging by beta testing and a huge social media response, Josephine believes the demand is there.However, getting all the interested parties on board has not been easy, Josephine says, because there are credibility problems for young graduates.“I remember my first pitch. I wore a suit and everything, but [the tailor’s] reaction was: ‘How old are you? You look like my 14-year-old daughter.’”She won him over by using him for a trial period and bringing him 20 new customers and hundreds of pounds in work, she says.Her business officially launches this month and Josephine says she is not anxious, “just incredibly overwhelmed” with optimism.She thought she would struggle to recruit the cyclists to collect the clothes, but more than 60 applied for 20 positions.Her advice to other budding entrepreneurs is this: “Young females like me can struggle with confidence, but you just need to educate yourself in your market. I went to lots of events both online and in person, about things like marketing and pitching to investors, which really helped me.”“If it really took off I would pursue it full-time,” says Sehrish Ahmed, 22. “I’ve always wanted to be a business owner.”The entrepreneurial graduate is now running an online jewellery business called Rose Eclipse, but this wasn’t the original plan.While studying international fashion branding at Glasgow Caledonian University for the past three years, Sehrish’s mind was set on a career in fashion retail.To earn some money while studying, and gain experience, she worked on a diverse range of shop floors, including Oxfam, Gap, Mothercare and Victoria’s Secret – in the latter dressing mannequins. But then Covid struck. “The first thing that went through my mind was that I wouldn’t have a graduation, I wouldn’t walk on that stage, that’s the thing I’d been looking forward to,” says Sehrish.Then the implications for her future career became clear. Her graduate placements and internships were cancelled.So she decided to start her jewellery business, which until then had been just a pipe dream.After looking through samples, she sources her products from China, which are then posted to Glasgow.Sehrish’s advice to others in her situation is this: “I think with the majority of graduates being Gen Z, we are very aware of how social media works and we need to use that to our advantage.”Her sales have been driven by her Instagram and TikTok accounts. She used her knowledge of the platforms to create compelling posts and plug into the latest trends.“What surprised me was when I started to get sales from people who weren’t just friends and family,” says Sehrish.She’s now getting dozens of sales a month – not enough to make a living yet, but she wants to see if she can grow the business beyond a side hustle, something she hadn’t considered before.The coronavirus has thrown many graduates’ plans for the future up in the air. By starting their own businesses, some feel they are taking back control.You can follow CEO Secrets series producer Dougal on Twitter: @dougalshawbbc