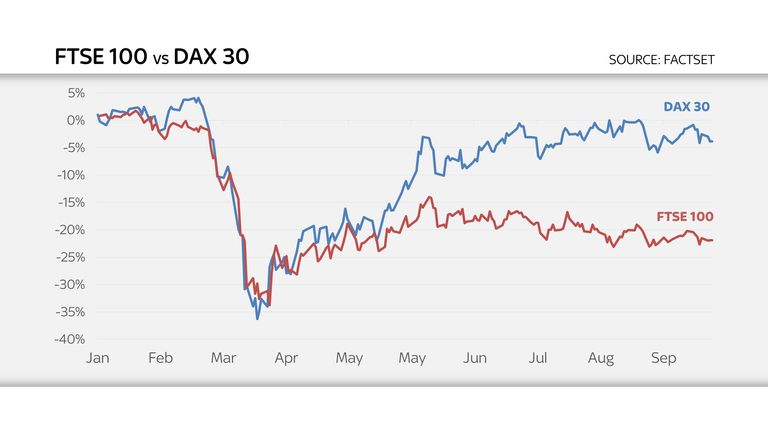

For casual observers, it must seem strange that the DAX 30, Germany’s leading stock index, is down by only 5% since the beginning of the year while the FTSE-100, its UK equivalent, is off by a thumping 23%.

Both, after all, are indices dominated by big multinational companies exposed not to their local economies but to the global economy.

The DAX admittedly has a greater proportion of tech stocks, the key area of outperformance this year, than the Footsie.

Companies in the German blue-chip index also do proportionately more business than their UK counterparts with China – the only leading economy in the world likely to grow this year.

By and large, though, the pair are pretty similar in their exposure to global GDP.

One major difference, though, is that British-listed companies, before the COVID-19 crisis, tended to pay out a higher proportion of their earnings in dividends.

The extent to which those dividends have been slashed recently is spelled out in the latest quarterly UK Dividend Monitor published by the investor services provider Link Group.

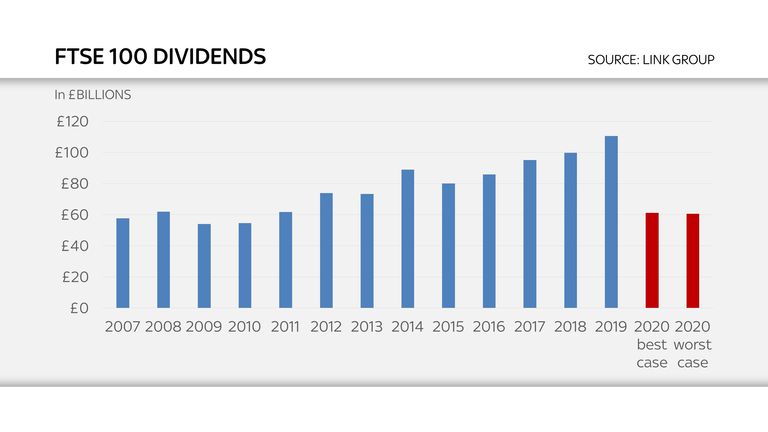

It reports that, during the three months to the end of September, dividends paid by UK listed companies fell by 49.1%, to £18bn, the lowest third-quarter total for a decade.

Even on an underlying basis, which strips out special dividends, pay-outs fell by 45.1% to £17.7bn.

Bad as that sounds, though, it was less brutal than the second quarter of the year, during which, dividends fell by 57% to £16.1bn.

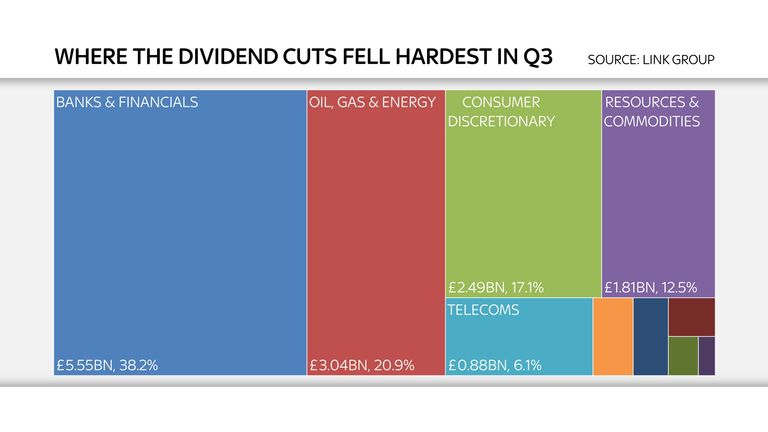

Of the £14.5bn cuts during the third quarter, almost two-fifths came from the banks, which were ordered by the Bank of England in the spring to dispense with dividends for the time being.

A further fifth came from the oil companies. Both BP and Royal Dutch Shell have cut their dividend in response to the crash in oil prices with the move from the latter, in particular, coming as a particular earthquake. It was Shell’s first dividend cut since the war.

The oil and gas sector previously accounted for around £1 in every £9 paid out in dividends by British companies.

Mining companies accounted for a further eighth of the overall reduction. That partly reflected the decision of the mining and commodity trading combine Glencore to pass its dividend entirely, but there was also damage done by cuts from BHP and Anglo American, whose earnings have been hit by falls in the value of commodities like copper.

In all, Link notes, just under half of companies cancelled their dividends altogether during the third quarter, while a further fifth cut them, meaning that almost two thirds of companies cut or cancelled their pay-outs altogether.

These are more than just numbers on a page.

Millions of private investors, especially pensioners, depend on dividend income. Worse still, the dividend reductions will have exacerbated deficits at a number of pension schemes, which were already widening because of the way ultra-low interest rates magnify their liabilities.

So these cuts will have led to real world pain, not only now but in the future, as their impact will also result in lasting damage to the retirement incomes of millions of people still in work.

The good news, according to Link, is that the dividend cuts may be past the worst, with some companies starting to pay dividends again or reinstating pay-outs that were suspended earlier this year.

In the latter camp are the defence contractor BAE Systems and the precision engineering and components maker IMI.

Tesco recently increased its dividend at the half year stage while Unilever, the food and household goods giant and now the largest company in the Footsie, has also just raised its pay-out.

Link goes on to observe: “The fourth quarter should look a little better than the third. This is partly because those companies that want to cut have already done so, limiting the downside to our figures.

“But it also reflects the likely restarting of dividends by companies like Bunzl and Land Securities; those like Ferguson, Softcat, and Bodycote which intend to catch up on payments missed earlier this year too; and positive signs from firms as diverse as Diageo, Hargreaves Lansdown and Biffa, all of which we had marked as vulnerable to Q4 cuts.”

The latest figures also, however, confirm the dominance of a few big companies in terms of pay-outs.

More than two-thirds of dividends from Footsie constituents during the third quarter were paid by just 15 companies, with a third being accounted for by just five – Rio Tinto, British American Tobacco, National Grid, Vodafone and Glaxosmithkline.

Link expects that, for the year as a whole, BAT is likely to be the biggest single dividend payer although, should the Bank allow banks to resume dividend payments, suggests that HSBC will reclaim the crown in 2021.

While this year’s dividend cuts will have filled many savers with despair, there is one good thing about them, which is that it means that the Footsie’s distributions are now more sustainable.

Too many blue-chips were paying dividends that were barely covered by earnings going into the crisis. The pandemic has provided cover to reduce their pay-outs to a more sensible level.

It is also worth noting that, taking into account Link’s forecasts for the next year, the Footsie will be yielding 3.6% in a best-case scenario and 3.3% in a worst case scenario (the yield is the dividend expressed as a percentage of the share price).

That still compares exceptionally favourably with the nugatory rates of interest paid by most cash savings accounts.