Fundsmith Equity crowned the best-selling fund since lockdown as the most bought funds, trusts and shares are revealed – and how they performed

- It has been six months since the UK was forced to go into lockdown on 23 March

- There has been a rise in private investing over the past six months across funds, trusts and especially stocks and shares

- Fundsmith Equity was the most bought fund and has returned just shy of 30%

Star manager Terry Smith’s £21billion Fundsmith Equity was the most bought fund during lockdown, according to new figures.

As today marks six months since the nationwide lockdown was enforced, DIY investing platform AJ Bell Youinvest has revealed the best-selling purchases during this time.

The £14billion Scottish Mortgage investment trust, which is also a FTSE 100 constituent, was the best-selling trust while UK bank Lloyds was the most bought share.

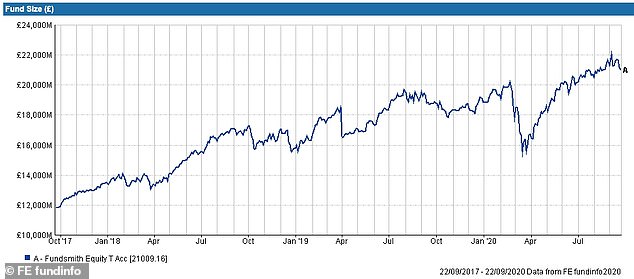

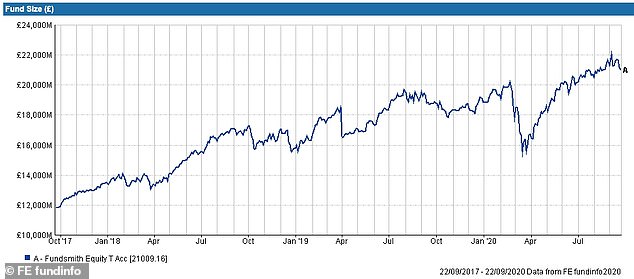

Terry Smith’s £21billion Fundsmith Equity fund has been the best-selling fund since lockdown

Smith’s Fundsmith Equity has always been a firm favourite in the investing world, and has only become more so during lockdown, which has seen a rise in DIY investing.

It fell in size from just under £20billion in February to a low of £15.5billion in the middle of March, when markets were at their most volatile.

It has since recovered, boasting a market cap up to as much as £22billion at the start of September.

Investors have clambered into funds they considered ‘safe’ due to their global and diversified nature during such an uncertain time.

Since 23 March, the fund has returned almost 30 per cent.

Fundsmith Equity has grown from around £15billion to £22billion over the past six months

Meanwhile, Nick Train’s £7.7billion Lindsell Train Global Equity fund was the second best-selling fund, followed by the £5billion Baillie Gifford American fund.

They have delivered 24.6 per cent and a staggering 101.3 per cent respectively. The top 10 funds have returned an average of 48 per cent over the past six months.

| Fund | Total return (%) |

|---|---|

| Fundsmith Equity | 28.7 |

| Lindsell Train Global Equity | 24.6 |

| Baillie Gifford American | 101.3 |

| Polar Capital Global Technology | 43.6 |

| Fidelity Index World | 31.6 |

| Baillie Gifford Positive Change | 71.3 |

| Fidelity Global Special Situations | 35.1 |

| L&G Global Technology | 47 |

| TB Evenlode Income | 25.3 |

| Baillie Gifford Global Discovery | 72.6 |

| Average total return of top ten | 48.10 |

| Source: AJ Bell Youinvest (23 March – 22 September 2020) | |

Baillie Gifford will have enjoyed its Positive Change and Global Discovery funds also featuring among the top 10 best-selling funds over lockdown, as well as its Scottish Mortgage investment trust being the most bought trust since 23 March.

The trust is the biggest in the closed-ended sector at £14billion, and is run by investing stalwarts James Anderson and Tom Slater.

It’s known for being a long-term holder of some of the world’s biggest technology companies such as Amazon, Tencent and Tesla, the latter of which was its top holding and represented 13 per cent of the portfolio in July.

Investors in Scottish Mortgage will have been pleased with a huge 108 per cent return since 23 March.

Other investment trust favourites include Janus Henderson’s City of London investment trust, Polar Capital Technology, Finsbury Growth and Income and Smithson.

The top 10 best-selling trusts have returned an average of 58.3 per cent.

| Trust | Total return (%) |

|---|---|

| Scottish Mortgage | 108 |

| Scottish Investment Trust | 22.2 |

| City of London | 16.1 |

| Polar Capital Technology | 63 |

| Finsbury Growth & Income | 26.7 |

| Smithson | 51.6 |

| F&C | 41.3 |

| Allianz Technology | 85.4 |

| Monks | 70 |

| Edinburgh Worldwide | 98.3 |

| Average total return of top ten | 58.3 |

| Source: AJ Bell Youinvest (23 March – 22 September 2020) | |

Ryan Hughes, head of active portfolios at AJ Bell, said many DIY investors saw the March stock market crash as an opportunity to adjust their portfolios, which is why trading volumes were high at the start of lockdown.

‘But what is really interesting is that the majority of these were people purchasing investments rather than selling them so clearly investors were looking to benefit from depressed prices rather than rushing for the exit,’ he said.

AJ Bell’s Hughes said technology has been a dominant theme among fund and trust picks

‘Many of the most popular funds and investment trusts are similar to the ones that were popular before the market crash so investors clearly haven’t shifted their thinking too much and they’ve been well rewarded for keeping faith in these managers as values have bounced back strongly.’

Hughes noted the clear global emphasis coming through among the most popular funds and, to a lesser degree, trusts, with technology being the most dominant theme.

He added: ‘This has been a good call by these investors as tech stocks have performed extremely well during the pandemic.

‘The question now for those investors is whether that party is over but with further lockdowns being implemented around the world, technology is still very much going to be at the forefront of people’s lives.’

What were the best-selling shares?

Alongside interior design, gardening and baking, more Britons have tapped into an undiscovered passion for investing in shares since lockdown.

This is Money spoke to a number of DIY investing platforms to find out how more of the nation became hooked on the stock market while in quarantine.

As for the shares they were buying, financial institutions, energy and aviation companies appeared to lead the way.

The best-selling share, according to AJ Bell, was Lloyds Banking Group, followed by BP, Royal Dutch Shell and International Consolidated Airlines.

All four companies are now down since 23 March, marking losses of 19.3 per cent, 0.8 per cent, 3.7 per cent and 20.5 per cent respectively.

This emphasises how volatile markets have been over the past six months as there have been times when all four companies were delivering exceptional day returns, hence their popularity.

Big pharma and biomedical firms were also among the most purchased, which is unsurprising given the spotlight currently held over them to help fight the coronavirus pandemic.

GlaxoSmithKline was the fifth most-bought share while Avacta Life Sciences came in at seventh and has delivered an eye-watering 832 per cent since lockdown.

The top 10 most purchased shares delivered the highest average return of 94.8 per cent, though Hughes points out that this is heavily skewed by Avacta’s astonishing return.

| Share | Total return (%) |

|---|---|

| Lloyds | -19.3 |

| BP | -0.8 |

| Royal Dutch Shell | -3.7 |

| International Consolidated Airlines | -20.5 |

| GlaxoSmithKline | 12.1 |

| EasyJet | -1.3 |

| Avacta Life Sciences | 832 |

| Barclays | 9.5 |

| Boohoo | 96.8 |

| Legal & General | 43.2 |

| Average total return of top ten | 94.8 |

| Source: AJ Bell Youinvest (23 March – 22 September 2020) | |