The FTSE 100 has seen £52bn wiped off its value in a single day as markets plunged on fears of tougher coronavirus restrictions.

London’s leading share index plunged by 3.4%, or 203 points, as part of a global sell-off that also saw European and US stocks succumb to heavy selling pressure.

The pound, too, was on the back foot as the prospect of more pain caused by the pandemic added to deepening worries over fraught Brexit trade deal talks.

Market analysts pointed to a string of value negative developments driving the FTSE lower as it plunged by 3% within the first couple of hours of trading on Monday – dipping further as government advisers warned strict measures would be needed to curb surging UK infection rates.

Companies exposed to any new COVID-19 restrictions, including travel firms and housebuilders, saw their stocks face a renewed run from risk.

The FTSE 100’s slump to 5804 points left it 23% down on the year to date – though still well above the nadir in March when coronavirus panic-selling saw it dip below the 5,000 mark.

Monday’s sell-off, which took £51.7bn off the combined value of the index’s constituent companies, was the biggest one-day slump since June.

British Airways’ owner IAG was the biggest faller, down by 12%, leaving its shares nearly 77% lower on where they started 2020.

Among the other losers were banks – hit by the publication of a report alleging that a number of global lenders had moved large sums of illicit funds over nearly two decades despite concerns over the money’s origin.

The money laundering claims, which extended to UK-listed HSBC and Standard Chartered, led to falls of more than 5% in their share prices taking HSBC’s market value to a 25-year low.

Another company to take a hit was Rolls-Royce which said on Monday morning it was looking to raise up to £2.5bn to strengthen its balance sheet.

The prospect of a rights issue helped take its shares nearly 11% lower.

Away from the FTSE 100, shares in the hospitality sector took a bad turn with Wagamama-owner The Restaurant Group, falling nearly 18%.

Other casualties feeling the hangover included JD Wetherspoon – down 9% – while the company behind Harvester and Toby Carvery, Mitchells & Butlers, saw its shares lose 15%.

The price pressures combined to help take the mid-cap FTSE 250 4% lower.

It was a similar story for equities across Europe after Asia started the week on the back foot.

The German DAX and CAC in Paris were around 4% lower while in New York the Dow Jones was about down by about 3% at the time of the close in London.

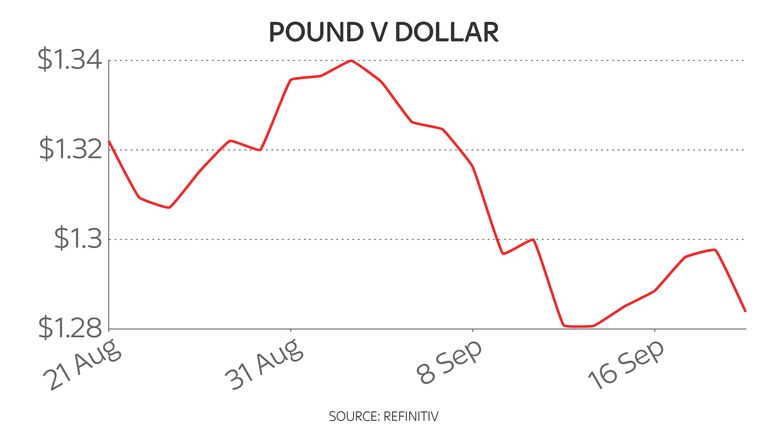

In the case of the pound, analysts pointed to fresh pressure from lockdown risks to the UK economy, as it lost more than a cent to dip below $1.28 versus the US dollar.

The currency – a barometer of the state of Brexit talks since the vote to leave the EU in 2016 – has already faced weeks of hardship as a result of the difficulties in trade negotiations.

Investors are demanding a deal to follow the Brexit transition period on 1 January.

Neil Wilson, chief market analyst at Markets.com, said the stock market falls were building on the “September blues” of the past few weeks that have seen the gloss removed from US tech stocks.

“European markets shot lower in early trade on Monday after US stocks fell for a third week in a row – the first such sustained decline in a year.

“The FTSE 100 headed under 5,900 and the DAX gave up the 13,000 handle as risk aversion spread across equity markets.”

He said of the virus link to the declines: “Tighter rules are almost certain as the authorities flounder and seem unable to get any kind of consistently clear approach to the pandemic.

“Travel and leisure was hit hard as new lockdowns and travel restrictions are an almost given heading into half term.”